“My son was diagnosed with congenital CMV, a virus that can cause hearing loss. As part of this diagnosis, he will be required to have routine hearing tests every few months until he is 10 years old. I reached out to you because I wanted to know why my son’s hearing tests weren’t covered by our insurance and why we needed to pay for it.”

— Anna Deutscher, 29, from Minnesota, writing about her infant son, Beckham

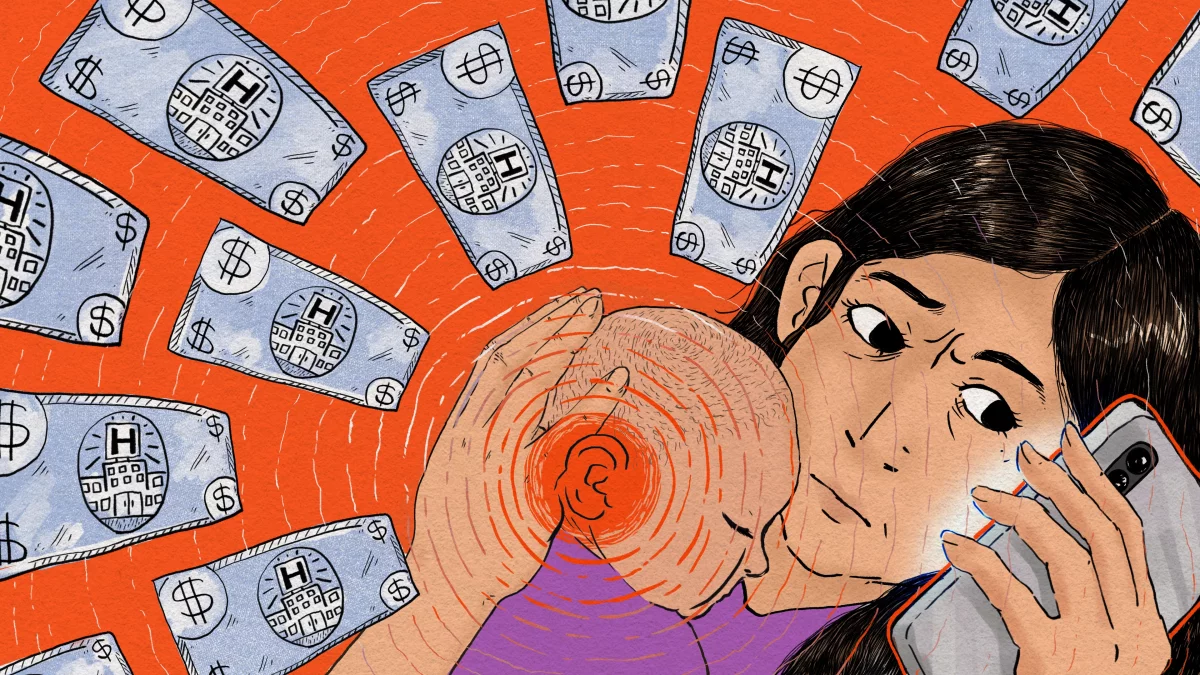

Trying to figure out why her claim was denied took Anna Deutscher a lot of time and work.

Baby Beckham’s hearing screenings were preventive care, which is supposed to be covered by law. Every hearing test cost them about $350 out of pocket. Between those bills and Beckham’s other health costs, the family maxed out two credit cards.

“Everything just immediately goes right to trying to pay that debt off,” Deutscher said.

At times, she felt overwhelmed by her son’s medical needs, on top of working. Deutscher said she “didn’t know what else to do” when her insurance company kept saying no to her requests that it pay for the hearing tests.

No one wants to spend time fighting their health insurance company. Many people feel they don’t have the knowledge or stamina to do it. But if, like Deutscher, you’re denied for a preventive service, it may be worth it.